Much of algorithmic trading powered by artificial intelligence now accounts for an estimated 60-70% of all U.S. equity trading volume.” This stark statistic underscores the seismic shift underway in the financial markets. AI is no longer a futuristic concept confined to research labs; it’s the driving force behind a growing portion of global financial transactions.

The influence of AI in finance is undeniable. The policies are evolving rapidly from sophisticated hedge funds deploying machine learning models to predict market swings to individual investors utilizing robo-advisors for portfolio management. Advancements like DeepSeek, a cutting-edge AI model, promise to revolutionize the industry further.

This increased accessibility of powerful AI tools presents a complex challenge for AI trading startups. While DeepSeek offers unprecedented opportunities for innovation and disruption, it also intensifies competition and raises the stakes for smaller players.

What Is DeepSeek? Why Is The Market Talking About It?

Simply put, DeepSeek represents a leap forward in AI technology, particularly relevant to the financial sector. While precise technical details are often proprietary, publicly available information suggests that DeepSeek boasts enhanced capabilities across several key areas.

It builds upon the foundation of transformer models, similar to those powering large language models like GPT, but with optimizations geared toward financial data analysis. This likely includes improvements in natural language processing (NLP) tailored for economic news, reports, and social media sentiment.

Furthermore, DeepSeek likely incorporates advanced statistical modeling and machine learning techniques to improve predictive analytics for market movements.

Due to a lack of standardized benchmarks, direct comparisons with other specialized financial AI models are limited. However, anecdotal evidence and early reports suggest DeepSeek may offer advantages in processing speed and the ability to handle more significant, more diverse datasets. Further research and independent analysis are needed to quantify these claims fully.

Key Features And Functionalities Of DeepSeek

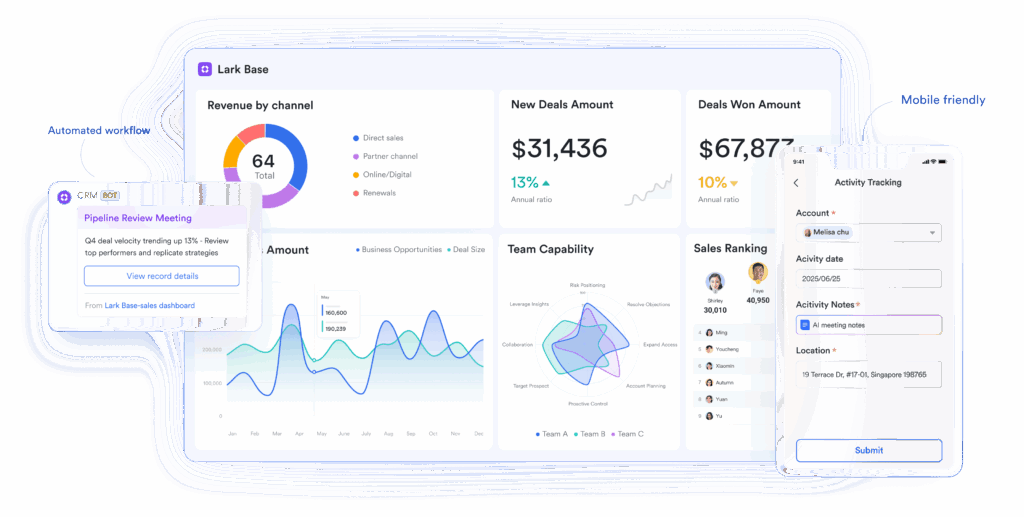

DeepSeek’s potential impact on trading stems from its key features and functionalities. Its enhanced NLP capabilities could allow trading algorithms to interpret better news sentiment, social media trends, and even analyst reports to gauge market sentiment more accurately. This is crucial for developing effective trading strategies.

Furthermore, its improved predictive analytics could lead to more accurate forecasts of asset price movements, enabling more profitable trading decisions. DeepSeek’s ability to rapidly process vast amounts of data can enhance risk assessment by identifying potential market risks and vulnerabilities in real time.

Finally, these combined functionalities can be integrated into sophisticated algorithmic trading platforms, allowing for automated execution of trading strategies based on real-time market analysis and predictions.

Comparison With Existing AI Models

Comparing DeepSeek with existing AI models, particularly those used in finance, is challenging due to the lack of publicly available, standardized benchmarks. While GPT models have demonstrated impressive capabilities in natural language processing, their general-purpose nature often limits their application in financial trading.

Conversely, specialized financial AI models are often trained on specific datasets and tailored for particular trading strategies, making direct comparisons difficult.

DeepSeek’s advantage likely lies in its ability to combine advanced NLP with enhanced predictive analytics and faster data processing. This combination could offer a more comprehensive and powerful tool for AI-driven trading.

However, the actual test of DeepSeek’s capabilities will be its performance in real-world trading scenarios and how effectively startups can use its features to develop innovative trading solutions.

The Threat To AI Trading Startups

Increased Competition

While DeepSeek’s accessibility is a boon in some respects, it also lowers the barrier to entry for new players in the AI trading space. This increased competition can significantly impact smaller startups.

A sudden influx of new companies, all vying for market share, could dilute the customer base and make it harder for startups to establish a foothold. Startups may be in a price war, forced to lower their fees to compete, which could squeeze profit margins and hinder long-term growth.

Furthermore, increased competition may accelerate innovation, requiring startups to constantly adapt and upgrade their technologies to stay ahead, straining their resources.

Resource Disparity

Large financial institutions have a significant advantage when integrating technologies like DeepSeek. Their vast financial resources allow them to invest heavily in infrastructure, data acquisition, and talent acquisition. This resource disparity can disadvantage startups.

Large institutions can afford to purchase larger datasets, hire top AI researchers and engineers, and build sophisticated trading platforms, giving them a significant edge in developing and deploying DeepSeek-powered trading strategies.

With their limited resources, startups may struggle to compete on the same level, potentially limiting their ability to innovate and scale their operations.

Talent Acquisition

The rise of DeepSeek and other advanced AI models is driving a surge in demand for AI talent. This increased demand makes it more complex and more expensive for startups to hire qualified professionals.

Large financial institutions, with their deeper pockets, can offer more competitive salaries and benefits packages, attracting the best AI researchers, data scientists, and software engineers.

Startups may find themselves priced out of the market, struggling to attract and retain the talent they need to develop and implement cutting-edge AI trading solutions. This talent shortage can hinder startups’ ability to innovate and compete effectively.

Data Dependency

DeepSeek, like all AI models, is heavily reliant on data. The more data it can access, the better it can learn and perform. Startups often face challenges in acquiring and accessing large, high-quality datasets.

This data dependency can be a significant hurdle for startups, as limited data access can hinder their ability to train their models effectively and develop accurate trading strategies. While some startups may explore partnerships with data providers, this can be costly and may not provide access to the specific data they need.

Ethical and Regulatory Concerns

The increasing use of AI in trading raises several ethical and regulatory concerns. DeepSeek’s capabilities, while powerful, also create the potential for misuse. For example, biased data used to train DeepSeek could lead to discriminatory trading outcomes.

Furthermore, the potential for market manipulation through AI-powered trading algorithms is a serious concern. Regulators are still grappling with how to address these ethical and regulatory challenges.

Startups operating in this space must know the evolving regulatory system and ensure their AI trading practices comply with all applicable laws and ethical guidelines. Failure to do so could lead to legal and reputational risks.

Opportunities For AI Trading Startups

Niche Specialization

Instead of trying to compete head-on with large institutions, AI trading startups can thrive by specializing in niche areas.

Focusing on specific asset classes (e.g., emerging market currencies, specific commodities), trading strategies (e.g., arbitrage, high-frequency trading within a narrow sector), or client segments (e.g., high-net-worth individuals interested in sustainable investments) allows startups to tailor DeepSeek’s capabilities to very specific needs.

This targeted approach can offer a competitive edge by providing highly specialized solutions that larger, more generalized platforms may overlook.

Innovation and Agility

Startups are inherently more agile and innovative than large corporations. This advantage allows them to quickly adapt DeepSeek to new trading strategies and changing market conditions.

They can experiment with new algorithms, test different data inputs, and iterate on their platforms much faster than larger, more bureaucratic institutions. This agility is crucial in the fast-paced world of AI-driven trading, where staying ahead of the curve is essential.

Collaboration and Partnerships

Startups should actively seek collaborations and partnerships to overcome resource limitations. Partnering with larger financial firms can provide access to valuable data, established infrastructure, and regulatory expertise.

Collaborating with specialized data providers can supplement a startup’s own data collection efforts. These strategic alliances can help startups level the playing field and accelerate their growth.

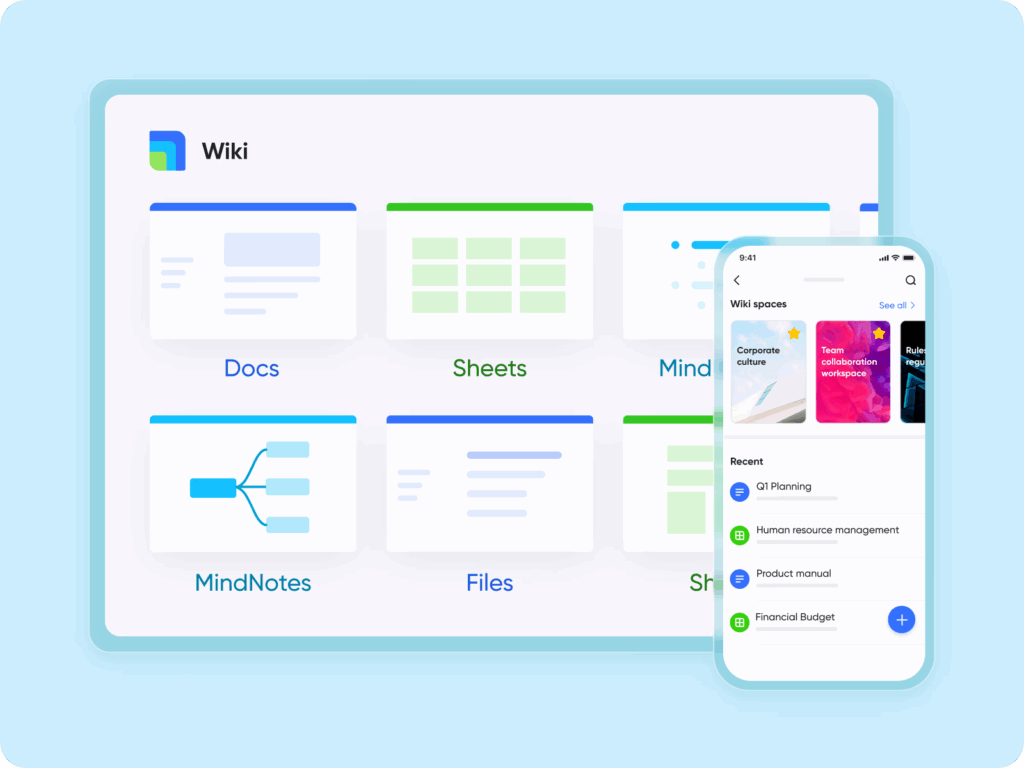

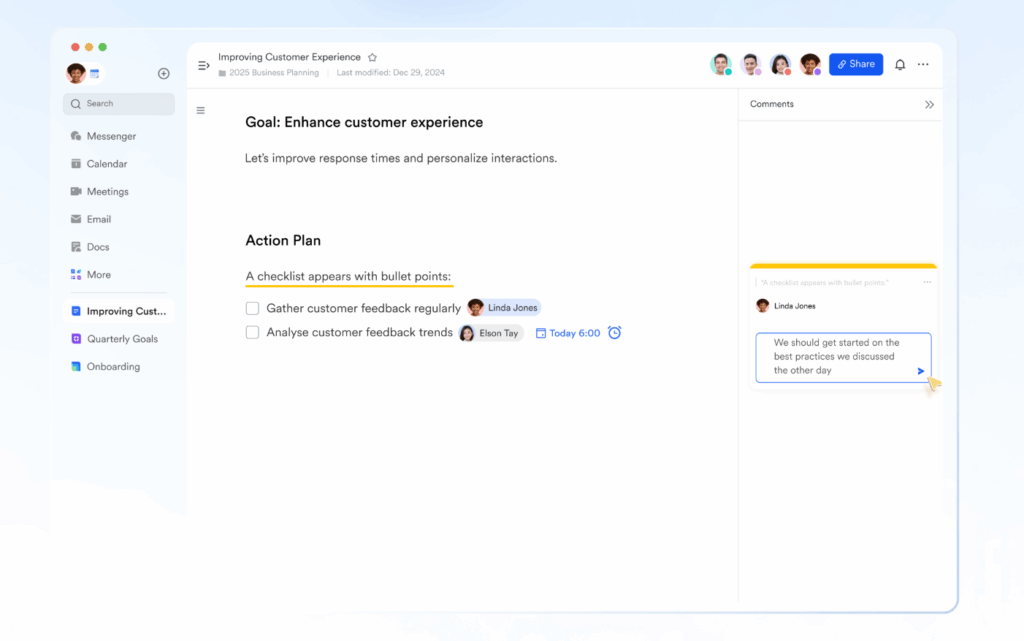

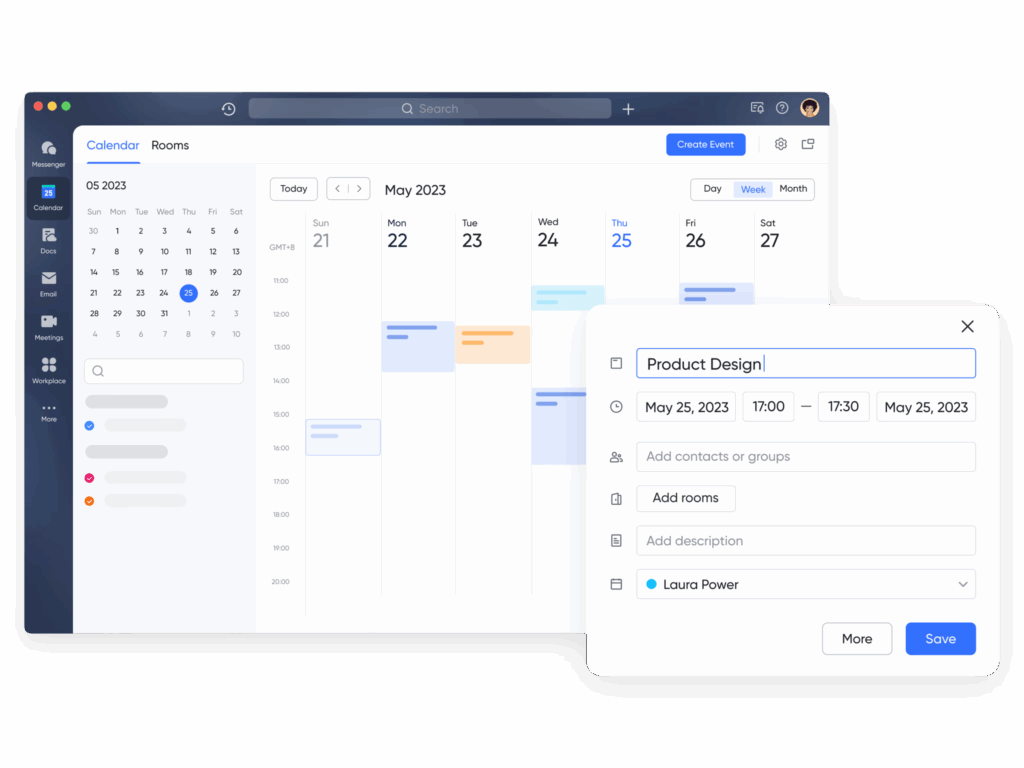

Focus on User Experience

In a market increasingly saturated with AI-powered tools, user experience becomes a key differentiator. Startups can focus on building intuitive and user-friendly platforms that integrate DeepSeek’s capabilities easily.

With specific user needs and providing a superior user experience, startups can attract and retain clients even if they lack the vast resources of larger competitors.

Democratization of AI Trading

DeepSeek’s accessibility has the potential to democratize AI trading, empowering smaller players and individual investors.

Startups can capitalize on this trend by developing affordable and accessible AI-powered trading tools for retail investors. This can open up new market opportunities and create a loyal customer base, driving growth and profitability.

AI, Bots, And Crypto Trading

DeepSeek’s advanced capabilities hold significant promise for enhancing crypto trading bots. The cryptocurrency market is notoriously volatile and driven by a complex interplay of factors, including market sentiment, news events, and regulatory changes.

DeepSeek’s enhanced natural language processing can enable crypto trading bots to analyze news articles, social media posts, and online forums to better gauge market sentiment and predict potential price swings.

Its improved predictive analytics can lead to more accurate forecasts of cryptocurrency price movements, allowing bots to make more informed trading decisions.

Furthermore, DeepSeek’s ability to process vast amounts of data in real time can help bots identify arbitrage opportunities and execute trades more efficiently.

Consider, for example, a hypothetical startup called Nearest Edge. It has developed a sophisticated crypto trading bot that uses DeepSeek’s capabilities to analyze market trends and execute trades automatically.

This kind of bot utilizes DeepSeek’s NLP to analyze news sentiment surrounding different cryptocurrencies, identifying potential catalysts for price increases or decreases. It also uses DeepSeek’s predictive analytics to forecast short-term price movements based on historical data and current market conditions.

Some crypto trading platforms are exploring the use of such bots to analyze market trends. Combining these functionalities, such bots aim to make more accurate and profitable trading decisions than traditional, less sophisticated bots.

Summing Up

The future of AI in trading, particularly for startups, is one of both immense potential and intense competition. While DeepSeek and similar technologies present challenges, they also offer unprecedented opportunities for innovation and disruption.

Startups that proactively explore DeepSeek’s potential, develop niche expertise, and focus on user experience will be best positioned to thrive in this evolving AI-driven trading structure.